|

|

"The Congress shall have Power to lay and collect Taxes, Duties, Imposts and

Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States; ...."

—The

Constitution for the United States of America; Article I, Section 8, Clause 1 ("1:8:1")

People Are NOT Goods and

Imports: . Persons are not the subjects of commerce,

and not being imported goods, they

do not fall within the meaning founded upon the constitution, of a power given

to congress, to regulate commerce, and the prohibition of the states for imposing a duty on imported goods.

Ibid; Gibbons v. Ogen 9

Wheat 1; 5 Cond. Rep. 562. .

Mandatory Public Notice In Regards To SSN and IRS Withholding .

Many, or some of us have heard that the W-4 withholding is voluntary and even though we have

stated this, and many others have, – it has gone unnoticed and unheard. Maybe because we have not read or

seen any documented proof (athough on this page is a wealth of information). Still our conditioning, and lack of study,

has it so that we are not aware of how unconstitutional it is for anyone to demand that one MUST participate and make either

SSN or IRS deductions. This is in accordance with the American Constitution of 1791, which is the law

of the Land, for all entities, associations, corporations, etc., established upon the land.

Constitutionally, withholding of anyone’s compensation for exchange of

their energy is in fact unconstitutional as the tax is imposed on the energy of the People, and it is an unconstitutional

act for a any corporation on record as NOT even being an agency of the federal government.

In

fact. not too long ago, you would see the postings in the employment office and at the workers lunch area, that expressed

rights as it relates to sexual harassment in the workplace, fair wage rates and other various types of discrimination and

issues relative to the rights of the worker.

As well, there is another body of information

that is supposed to be posted, as a requirement of ALL employers, and that is two Public Notices expressing

that the W-4 withholdings, inclusive of the SSN and IRS, are voluntary..…Have you seen it?

Click Below so you can review it. Pay close attention to the last line!!! ADDITIONALLY: Your employer, whoever that is, has an agreement with the respective

state in which they have established their business, and they have agreed to OFFER you the W-4 upon your hiring. They

have also agreed to be fined or sanctioned by the respective state if they (the employer) does not OFFER you the W-4 form.

What you need to know is that an offer may be made, but you have the right to refuse such offer and you are NOT to be terminated

as a result of it, as those deductions are IN FACT voluntary, thus is your choice and at your will and can be terminated

at your will. There is absolutely nothing unlawful about not wanting to make voluntary contributions. Because

the people have not known this, it has become common practice and expected 'income' for corporations and has escalated to

many being in fact threatened with termination by their employer. The employer may be beholding to the corporate state

it was established under and they have agreed to comply as an agent of same. But that does not infringe upon you and

your rights to volunteer or to contract or not. You cannot be compelled to act or contract. The important factor

is we don't take the time to identify the 'parties' involved, or to 'follow the 'money' trail to know who is behind the scene

extorting finances via human energy and threat, duress and coercion. Simply, say thank you to the employer, but I do

not volunteer to make contributions. Do not argue with your employer, simply state your position and if necessary, tell

your employer you are aware they are subject to being fined or sanctioned by the state if they do not offer the form (instead

of letting them tell you it is the law, when it is not). Therefore, you will put in writing, as proof and evidence that

the employer did in fact offer the W-4 to you, and they can send that statement to their respective 'Tax Consultant' for the

record, which eliminates them from being fined or sanctioned and proves they did their part in offering it. No one can

make you volunteer, no one can make you contribute, as contributions mean they are voluntary in their nature. You

must wake up and start thinking critically. The problem we have

is called 'attitude', often we take an attitude with this information and therefore create our own problems.

We say too much, yet not enough, and / or not the 'right words', and speak with an attitude that is used against us, as you

are to speak in an intelligent tone at all times. We trust it is because of lack of knowledge and we trust that what

is being shared here, will help you to curb your attitude and enforce the law in simplicity. Click below for the Public Notices: .

SSN Public Notice

IRS Public Notice

.

. Definition of Income Tax: A tax relating to the product or income from

property or from business pursuits; a tax on the yearly profits arising from property, professions, trades, or

offices; a tax on a person's income, emoluments, profits, and the like, or the excess thereof over a certain amount.

Interstate Bond Co., v. State Reveunue commission of Georgia, 50 Ga.App. 744, 179 S.E.

559. . "An income tax is not levied upon property, funds, or profits, but upon the right

of an individual or corporation to receive income or profits (status).

A tax on incomes is sometimes said to be an excise tax and not a tax on property, Hattlesburg

Grocery Co., Robertson, 126 Miss. 34, 88 So. 4,5, 25 A.L.R. 748; nor on buisness, but on a

tax on the proceeds arising therefrom, Young v. Illinois Athletic Club, 310 Ill.,

75, 141 N.E. 369. 371, 30 A.L.R. 985. but in other cases

an excise tax. . An "excise tax" is an indirect charge for the privilege of following an occupation

or trade or carrying on a business: while an "income tax" is a direct tax imposed upon income, and

is as directly imposed as is a tax on land. United States v. Philadelphia, B.&W.R.

Co., D.C.Pa., 262 F. 188, 190. .

United States Government under Oath Denies IRS is an Agency of the Government - PDF

This Certified Copy is proof of the tangled

web that has been weaved and it requires serious studies and obtainment of knowledge by each of us to 'get it',

as they (IRS) have been very infringing and have used force and collusion with other corporations, which includes the

Banks, the Counties (which are ALSO corporations and NOT government) and YOUR job. Pay attention to

Paragraph #4. Time to put it all in order. .

U.S. Court of Appeals Rules IRS Cannot

Apply Force Against a Tax payer Without a Federal Court Order. Tax Payers Free to Ignore an IRS Summons.

Queensbury, NY – On January 25, 2005, the U.S. Court of Appeals for the Second Circuit

held that taxpayers cannot be compelled by the IRS to turn over personal and private property to the IRS, absent a federal

court order. Quoting from the decision (Schulz v. IRS, Case No. 04-0196-cv): “…absent an effort

to seek enforcement through a federal court, IRS summonses apply no force to taxpayers, and no consequence whatever can befall

a taxpayer who refuses, ignore, or otherwise does not comply with an IRS summons until that summons is backed by a federal

court order. [a taxpayer] cannot be held in contempt, arrested, detained, or otherwise punished for refusing

to comply with the original IRS summons, no matter the taxpayers’ reasons, or lack of reasons for so refusing.”

Without declaring

those provisions of the Code unconstitutional on their face, the court, in effect, nullified key enforcement provisions of

the Internal Revenue Code striping the IRS of much of its power to compel compliance with its administrative demands for personal

and private property. The court characterized IRS summonses issued under Section 7602 as mere “requests.”

The court

went on to say that the federal courts are there to protect taxpayers from an “overreaching IRS, and that the

IRS must go through the federal courts before force can be applied on anyone by the IRS to turn over

personal and private property to the IRS. .

PDF of Above Case Synopsis - 1 Pg. PDF

PDf Full Case Report Schulz v. IRS - 5 pgs.

. Below is NEWLY posted Additional Letter from IRS Disclosure Representative

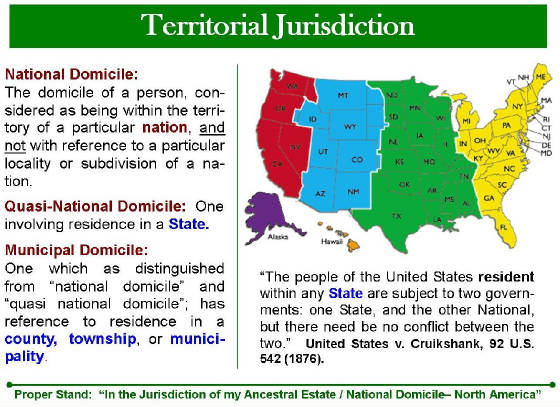

and a Territorial Jurisdiction Map we provided for edification and qualification of Domicile. .

This is another IMPACTING letter. This

one is from Cynthia J. Mills, IRS Disclosure Officer 1995 in regards to the fact that IRS is NOT positive law, but is for

those who CHOOSE to subject themselves to it by voluntarily entering into an employee agreement. This one is not a great

copy. We retyped it for clarity as a PDF. .

Click here to view or download the original and the re-typed letter

. Please Note that these rulings are based

in Law and in the fact that Income Taxes are VOLUNTARY; Sales Taxes are for those who are selling goods and imports,

it is not a 'Buyers' Tax; Taxes can only be levied on Corporate Officers, Employees of the United States - NOT THE NATURAL

PEOPLE. It is ultra important to know who you are in your status, which means your relationship to the community

/ sociey. Read some of the additional letters from Congressman and IRS Disclosure Representatives on this site as it

relates to Taxes. Yes, Taxation WITHOUT Representation is a fact - STOP being in the numbers of a Union State, that

must adhere to the American Union wherein the Constitution of the United States 1791 is the Supreme Law of

the Land. As well, ALL Union States are Quasi-National domiciles. Cities, townships, boroughs,

are Municipal Domicles registered under the Union State. You are of a National National Domicile,

and are an aboriginal and indigenous being of the land and CANNOT be a member / citizen of the Union States.

STOP fattening them up, while they rape you of your god-given unalienable rights to breath and to live off of the land, which

cannot be bought, sold, nor transferred and certainly NOT by them, as it is not their land, nor is it their Ancestral Estate,

no matter what imaginary sub-divisions they apply to it. .

| Territorial Jurisdiction |

|

| Are You Domiciled? - If So - Where? |

.

. THE SSN NUMBER IS WHAT IS USED TO 'TAX' YOU Because

it is ISSUED by Quasi- National Domiciles for THEIR Citizens

. You are being taxed via the Social Security Number. They present

it as a contribution and a contribution is voluntary. Therefore, you decide if you are or are not an active member making

vountary contributions or not. They also present a contribution to an insurance policy as mandatory via threat and coercion,

which is a violation of the First Amendment in regards to your right to free associations. Truth and Falsehood is strangely

mixed. The following is a brief paragraph that explains your position in NOT having a SSN number and NOT participating

in that private social insurance administration policy, and how it can, and ought be utilized to admonish forced coercions.

Offers are made from many angles to convince and coerce you. It is your decision, it is not a Mandatory

Government must do. I am not a member of the private Social Security Administration Corporation, therefore

I do not have a social insurance policy. I do not participate in the social security voluntary contribution

system, thus there is no SSN to provide. However,

because I am not a member of the private social insurance corporation is not a reason to deny any right, privilege or service.

Freezing any acount, business, or activity I currently have, or intent to have, or denying any potential association

with you, potentially creates 'Moral Duress'.

MORE ON SSN FURTHER ON THIS

PAGE. .

BIG TIME NEWS In Regards to The IRS - Note: Please consider that the first Writs blasted by you the people, seemed to

get the IRS under investigation, and the 'BOLO' list they were not willing to disclose is obviously to "be on

the look out" (BOLO) for the natural people who are not OBLIGATED to pay taxes, especially the

Moors who are aboriginal and indigenous and who know and are proclaiming this is their ancestral estate and National Domicile

and they are NOT subjects to the corporations and their theft practices, nor must they apply for tax exemptions, 501C,

etc., because they are not obligated in the FIRST place, as excise taxes, income taxes and sales taxes are

for corporations and Federal Employees / Servants or those who are members / citizens of the corporation,

which is very, very logical that they would pay membership dues. If you are a corporate member/ citizen

what is left after your listed expenses would in fact be the 'profit from a corporate investment'

(definition of Income) because to them YOU are the Corporate Investment. By being a citizen of a corporation, you

cannot be anything other then a member, an employee, a servant, and / or officer of, and admitted federal employee of

that corporation (also logical). Corporations can exist all day long, but they CANNOT infringe upon the rights

of the natural people. Any Court (if they are a court) are in collusion if they entertain or allow these unconstitutional,

non-sanctioned levies and straight out theft of one's labor wages to continue to go on. At the same time, if you

receive compensation for your labor, you need to know it is NOT income, thus your words admit to it being so, as it means

the profits from a corporate investment and is NOT the same as labor wages. STILL these actions by trickery and does

not make any of it lawful, in fact makes it Fraud, as the IRS is not sanctioned to levy taxes (See letter from Congressmen Hertzel (also further on page with short explanation). They ONLY apply to corporations who hire them as they [IRS]

are a private accountant firm for hire. There is such a thing as a tribunal for taxes, but they are NOT

Courts of Law, they are tribunals for corporations and deal with the business of corporations. It is time to stop

confusing the two and / or allowing anyone else to confuse the two as it pertains to your private affairs. . The answer as to "is it true" is

not only answered, but is clear. As to whether it is applied, is up to you-- the People. If you are not interested

in terminating the violations made upon you, don't complain, but do accept others who wish not to be violated.

Congress is the only one to proportion or levy taxes and if they are not doing so, as they [congress] are in cine

dia, then it ain't happening. The IRS is a private Trust and there is no way the people ought be supplying finances

to a non-disclosed group of people in a private Trust. This is beyond absurd. But that is what happens when the

people lack knowledge, it affects us all. .

Swanson-FloSystems Co. vs. Commissioner No.27975

IRS Correspondents with you must be

a flesh and blood being and must show a claim by them as a Complainant! No More Hiding Behind Form Letters and

False Claims. No more accusing YOU of making frivolous claims!! .

. Sales Tax NOT for Natural People: Sales

Taxes were never meant for the 'Natural Person' to pay. Thus paying them is a voluntary compliance. Sales

Taxes are applied to goods and imports, thus the Retail Store must pay them, not the natural person. . When the Constitution

speaks about Persons as it relates to commerce they are NOT talking about Natural Persons. The following in regards

to same comes from the footnotes of the Statutes At Large: Persons are not the subjects of commerce, and not being imported goods, they do not fall within the meaning founded upon the

constitution, of a power given to congress, to regulate commerce, and the prohibition of the states for imposing a

duty on imported goods. Ibid; gibbons v. Ogen 9 Wheat 1; 5 Cond. Rep. 562.

"Let

me point this out now. Your income tax is 100 percent voluntary tax, and your liquor tax is 100 percent enforced tax. Now,

the situation is as different as night and day. Consequently, your same rules just will not apply...".

-Dwight E. Avis, former head of the Alcohol and

Tobacco Tax Division of the IRS, testifying before a House Ways and Means subcommittee in 1953. .

Income

Taxes are for Federal Employees to pay. A 'Federal Citizen' is one who works for the United States of America. The

United States of America is a corporation and if one is a citizen of it, they are a corporate person citizen, and must pay

taxes - Not the natural person of which all federal employees / public servants work for the purpose of upholding and preserving

the unalienable rights of the natural person. They

are Trustees with a derived authority (Constituion). The articles within the Constitution describe their duties

and obligations as Trustees. The Constitution is the Law of the land, and if natural people

do not want to be molested they must enforce the constitution and be sure it is not violated against them. This

is the already established law and there is no other Law in this land. There exist "color-of-Law" which is

negative law as opposed to positive law.

State Governments are but Trustees with a derived Authority 4 Wheat 402 Penhallow V. Doane’s, Adminstrator’s defined government succinctly.

“Governments are corporations”, in as much as every government is an artificial person, an abstraction,

a creature of the mind only, a government can deal only with artificial persons. The imaginary, having

no reality or substance cannot create or attain parity with the real.

An "employee" is one who is employed by the federal government.

An "employer" is the federal government.

An "individual" is

a citizen of Guam or the U.S. Virgin Islands.

A "business" is defined as a government, a bank, or an insurance company.

Volunteer Taxpayers: We are subject to the laws of the jurisdiction which we volunteer to accept. In the law governing income tax,

"income" is defined as foreign earned income, offshore oil well or windfall profits, and war profits.

.

Below is a lettter from Congressmen Hertel dated December 30, 1985 .

. ...’does

not provide authority to levy wages of private citizens in the private sector. . .

Click Here To View or Download - PDF

.

Below is another letter. This one is from Senator Mark L. Forman, Legislative Correspondent in regards to voluntary

compliance, dated June 29, 1985. . . "Based on the research performed by the Congressional

Research Service, there is no provision which specifically and unequivocally requires an individual to pay income taxes." . .

Click Here To View or Download Letter

The IRS is a Private for Profit, For Hire, Accounting Firm. They are NOT

a Government Agency. Did you Hire Them? . Not

Created by Congress The Bureau of Internal Revenue, and the alleged Internal Revenue Service, were not created

by Congress. These are not organizations or agencies of the Department of the Treasury, or of the federal government. They

appear to be operated through pure trusts administered by the Secretary of the Treasury (the Trustee). The Settler of the

trusts and the Beneficiary or Beneficiaries are unknown. According to the law governing trusts, the information does not have

to be revealed.

IRS INCORPORATION PAPERS - PDF

Social Security Social

Security is a private insurance policy supposedly for old age. Families need

to first and foremost think in terms to take care of their own elders as part of their social obligation

of order and respect. Elders become an even greater source of wisdom and experience for both that of which

you do and that of which you don't do. .

.

"Considering that senior officials at the Internal Revenue Service are fully aware of the fact that

there is no law currently in existence making a U.S. citizen liable for or required to pay either the income tax or the social

security employment tax, only a truly generous citizen would, upon discovering this, continue to voluntarily donate these

taxes to the government by allowing them to be withheld from his paycheck on a 100% voluntary W-4 withholding agreement. But,

then again, the IRS would be dead in the water without the "voluntary (and docile) compliance" of employers

and employees and has said so all along." -- William Cash, IRS Senior Manager, http://www.irs.faithweb.com . Under the Privacy Act, 1974, Section 7:

(a)(1)

It shall be unlawful for any Federal, State or local government agency to deny

to any individual any right, benefit, or privilege provided by law because of such individual refusal to disclose his or her

social security number. Pub,

L.93-579, Section 7;5 U.S.C. Sec. 552a. Note:

unless (2) Disclosure is required by federal statute for welfare recipients

to obtain and provide SSNs of children. .

Section (b) Any Federal, State or

local government Agency which requests an individual to disclose his social security account number shall inform that individual

whether that disclosure is mandatory or voluntary, by what statutory or other authority such number is solicited, and what

uses will be made of it.

“Right of privacy is a personal right designed to protect a person from unwanted

disclosure of personal information.” CNA Financial

Corporation v Local 743, 515 F. Supp.942 . Under 42USC 408, it is a Felony

to use threat, duress, or coercion to try to force a person by fear or deceit to provide a SSN.

|